The Wolf of MWC

Last week at MWC25, I passed by SpaceX’s Starlink stand. It wasn’t on the show floor inside the Fira; instead, it was in the space outside—between Halls 4 and 5. I thought to myself, “Wow, if that isn’t a metaphor for disruption, I don’t know what is.” A wolf in sheep’s clothing, right in the middle of MWC.

When the world’s richest man starts to horn in on your industry, you may want to sit up and pay attention. Yet telcos worldwide are rushing to sign partnerships with Elon Musk’s Starlink without fully considering the long-term implications. Are these win-win deals, or are we inviting the proverbial fox to guard the henhouse? We’ve seen this movie before, and it rarely ends well for incumbents.

What’s the deal with Starlink?

Starlink is SpaceX’s ambitious low-Earth orbit (LEO) satellite internet constellation. With thousands of satellites already in orbit (and launching more regularly), Starlink can deliver connectivity virtually anywhere on the planet.

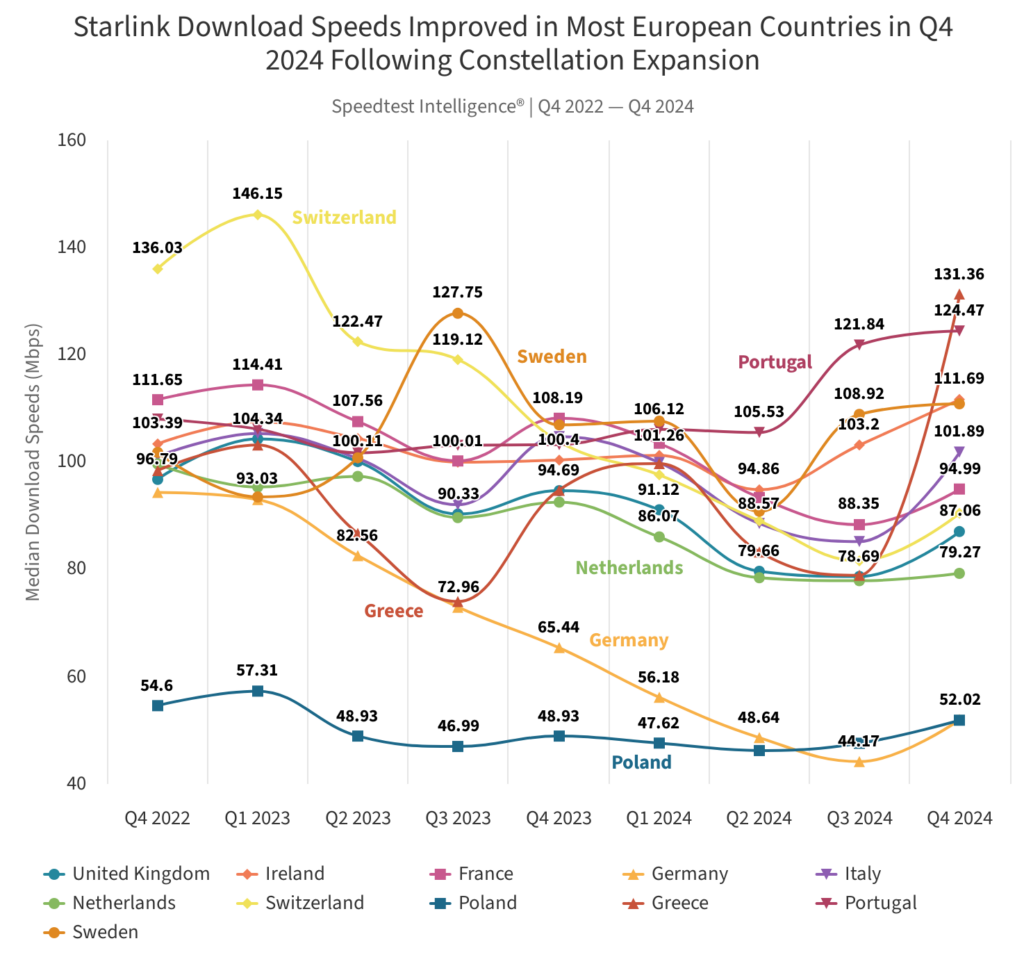

Initially dismissed by experts as too weak to compete with traditional broadband, Starlink has defied expectations with impressive performance improvements. Recent data shows latency dropping below 50 milliseconds (ms) in Western Europe and significant speed boosts in multiple countries. Look at the chart below (Figure 1). It shows download speeds jumping dramatically quarter over quarter. This is the real deal, and improving at a pace that should terrify telcos still operating on five-year upgrade cycles.

Figure 1 1

Telcos’ partnerships with Starlink look straightforward on the surface: Operators get to leverage Starlink’s direct-to-cell technology to enhance their service offerings, subscribers get extended coverage and service options (especially in areas where traditional infrastructure is impractical or damaged), and Starlink looks like a hero giving away free cell service every time there’s a natural disaster. Meanwhile, it quietly gains familiarity on its use, access to your customer base, and regulatory permissions. It’s brilliant.

Beyond that, Elon Musk appears to have a much bigger vision: creating a seamless global communications network that will eventually link Earth with Mars. While telcos are STILL arguing about whether they should use the public cloud, Musk is building a system that could eventually dominate the entire connectivity ecosystem.

Is Musk executing a classic ‘thin edge of the wedge’ strategy? Like AWS beginning as simple cloud storage before becoming enterprise infrastructure, or smartphones starting as niche devices before redefining computing, Starlink is making its initial moves appear unthreatening while building toward a much more ambitious vision. This could be a case of telcos playing checkers, while Elon plays 4D chess. And history shows Elon usually wins.

Why telcos are signing up

Starlink’s strategy isn’t to compete with operators directly (yet). Instead, it’s positioning itself as a complementary infrastructure provider. From telcos’ perspective, the appeal is obvious. Working with Starlink, they get:

- Enhanced coverage: Instant service expansion into remote, previously unprofitable areas

- Disaster resilience: Backup connectivity when terrestrial infrastructure fails during emergencies

- Cost efficiency: Avoiding massive infrastructure investments in challenging terrain

These benefits solve pressing business challenges, which explains the rush to sign deals. But telcos are relying on short-term thinking that masks a concerning long-term trajectory. This is EXACTLY how disruption works: the new player starts as your “partner,” then gradually eats your lunch. Just ask the music industry how their “partnership” with iTunes worked out.

You could also take a look at T-Mobile’s deal with Starlink to provide satellite-based text messaging. The operator’s Super Bowl 2025 ad invited “anyone, on any wireless carrier” to try its Starlink texting service for free. The marketing stunt generated massive engagement—12.6 times more than the median Super Bowl ad—giving T-Mobile access to well-qualified potential customers from competitors. Great move, right?

Maybe. While T-Mobile gets immediate benefits, it’s also helping Starlink establish a direct relationship with consumers. The current implementation uses just 2×5 MHz in T-Mobile’s PCS band, which severely limits what the service can deliver. But that’s exactly the point—Starlink doesn’t need to match 5G performance immediately to establish its beachhead. The technical performance will improve over time, just as the business relationship will expand beyond basic texting. Yes, there are significant technical hurdles before satellites can match 5G performance, but the initial wedge is already in place. Starlink is playing the long game, and it’s improving its technology at a pace terrestrial networks can’t match.

Win-win, or Trojan horse?

The question operators need to be asking themselves is whether a Starlink partnership undermines their core strategic position. If you limit Starlink to just emergencies, you’re probably okay. If you start to rely on it for broader service delivery, you’re potentially signing your own disruption warrant.

Here are the big risks:

1. Surrendering territorial control

Telcos are effectively giving Starlink control over the “last-mile” infrastructure in rural areas, which undermines one of their key strategic assets. Rural coverage—historically very expensive to provide because of its inherent low density—gave operators complete end-to-end customer relationships, network control, strategic presence, and political capital through universal service provision. If Starlink starts to handle rural coverage, telcos become dependent on Starlink for service delivery, creating a situation that’s extremely difficult and expensive to reverse.

2. Creating dependency

As telcos integrate more deeply with Starlink, they may become increasingly dependent on SpaceX infrastructure, opening the door to Starlink’s ability to:

- Renegotiate terms from a position of strength

- Prioritize its own direct customers over telco partners

- Dictate technical standards and integration requirements

What makes this dependency particularly dangerous is that it represents a one-way door. Once telcos begin outsourcing their core infrastructure, it becomes exponentially harder to reverse course, especially as industry economics shift and competitors move in the same direction. The telecommunications industry has historically been vertically integrated for good reason—control of infrastructure means control of your strategic destiny.

3. Enabling market disruption

Starlink’s direct-to-cell technology allows unmodified smartphones to connect directly to satellites, bypassing traditional cell towers. This arrangement poses an existential threat to the infrastructure-dependent business models of traditional telcos, which risk becoming “dumb pipes” while Starlink controls the more valuable space infrastructure. As satellite technology improves, there’s nothing stopping Starlink from expanding from rural to suburban areas, eating progressively into telcos’ core territories.

Don’t get blindsided

Musk is building a comprehensive telecommunications infrastructure that already spans continents and may eventually span planets. Meanwhile, telcos are focused on country-scale operations and quarterly results.

What makes these partnerships particularly dangerous is that Musk has both the funding to execute his vision and a vested interest in doing so. Unlike cloud providers (which weren’t trying to build networks but rather horizontal enterprise software), Musk appears to be targeting the telecommunications space directly.

It’s fair for telcos to wonder if they should partner with a different satellite provider. While that would theoretically reduce dependency on Musk’s empire, it’s not a great solution. Starlink has thousands of satellites in orbit, while the closest competitors have only a fraction of that number.

And Elon has a unique advantage—Starlink’s alignment with SpaceX’s rocket business and Mars ambitions means he can deploy satellites at a fraction of what it costs his competitors. Every Falcon 9 launch can carry dozens of Starlink satellites as essentially a vertically integrated operation, while competitors have to pay full price for their launch services. It’s a cost structure advantage that makes the constellation-size gap nearly impossible to close. The other guys simply can’t deliver comparable coverage or performance. Plus, choosing another provider doesn’t solve the fundamental risk—it merely exchanges one set of compromises for another.

Some operators are trying different approaches. Vodafone has formed a joint venture with AST (one of the “other guys”) to create a satellite mobile service across Europe, positioning itself to compete with Starlink rather than depend on it. Whether this strategy succeeds remains to be seen, but at least it’s taking control of its destiny rather than handing it to Musk.

Take the long view

The whole situation is eerily reminiscent of how cable companies initially ignored rural markets, allowing satellite TV providers like DirecTV to establish a strong foothold. The difference now is that telcos aren’t just leaving a market gap—they’re actively helping Starlink establish its position by providing spectrum access and network integration.

This follows a broader pattern that extends beyond telecom. When an industry begins modularizing what was once vertically integrated, power typically flows to the layer with the strongest aggregation effects. If Starlink becomes the dominant space-based infrastructure layer, telcos risk becoming merely service providers on someone else’s platform—a position with ever-diminishing leverage and margins.

I’m not saying telcos shouldn’t partner with satellite providers. But after decades watching operators get outmaneuvered by nimble, tech-savvy players, this situation is triggering my spidey sense. Go into these partnerships with eyes WIDE open and a clear Plan B.

Remember, the Trojan Horse looked like a gift too.

1 Starlink Shines in Europe as Constellation Investments Boost Performance

2 Will LEO Satellite Direct-to-Cell Networks make Terrestrial Networks Obsolete?

Recent Posts

Get my FREE insider newsletter, delivered every two weeks, with curated content to help telco execs across the globe move to the public cloud.

Get my FREE insider newsletter, delivered every two weeks, with curated content to help telco execs across the globe move to the public cloud.

Get started

Contact Totogi today to start your cloud and AI journey and achieve up to 80% lower TCO and 20% higher ARPU.

Dive deep

Read this Appledore Research white paper about how GenAI is poised to upend the telecommunications industry.

Engage

Set up a meeting with the Totogi team to find out how we can help you transform your telco.

Explore

Listen to Danielle Rios, acting CEO of Totogi, define her vision for the AI-first telco in her MWC25 Gen AI Summit talk.